Content

Of those boffins, French mathematician Paul Pierre Levy is actually credited with popularizing the new martingale system to own winning gambling. You lost $150 in the 1st five coin flips because you doubled off your risk after every loss. But for the 5th flip, your obtained and you can received $160, that was enough currency to recover your $150 losings and also build a good $ten money.

Downsides And Risks

That is most likely why Martindale promoted the methods; the guy in reality had the newest gambling enterprise, after all. The risks much surpass the pros, and it also requires way too much wide range in order to environment extended losing lines. Development an extensive trading package is essential to have properly applying the newest Martingale approach.

It enables an investor to take advantageous asset of their successful development from the mrbetlogin.com proceed this link now doubling the position. When you’re change to the a good forex platform, attempt to do your research to identify the brand new money sets you need to change on the, initial having quick lot types. That said, the newest Martingale technique is smaller precarious within the the forex market than simply it is during stock locations. Whether or not, a good money will get belong worth, that is somewhat sharp and you may unforeseen. However, this doesn’t constantly happen which can be an example to own a great pretty good reason. Change models deploying a good Martingale means is arrived at somewhat a considerable share in the hope from healing.

Martingale Means’s Therapy, Chance Management and Industry Standards

- Determine the fresh direction of your development (including, utilizing the Swinging averages sign).

- Thus, the new Martingale strategy will be used carefully, and you will people just who trade to the systems for example Quotex should be aware of your own risks in it.

- In the first place, it’s best for staying it a small percentage away from the trading membership.

- If your stock rates have falling and also you keep doubling your own financing, it might get to the part in which you’ll have absolutely nothing kept to set up.

The idea is that an absolute trade often recover the prior loss and you will lead to a return. The fresh Martingale technique is a period-checked approach that involves increasing your position dimensions after each and every losses. The brand new key suggestion behind this procedure should be to get well prior losings and build money because of the capitalizing on the newest ultimate winnings. Unlike repaired condition measurements, in which exchange numbers remain constant, the new martingale strategy comes to increasing the positioning proportions dynamically in reaction to sell effects. The newest Martingale technique is a high-exposure money management strategy that requires doubling the career size after all of the dropping trade. While it can make short-name growth, this isn’t suitable for forex trading as you possibly can lead to help you extreme losings whenever consecutive losing investments exist, that’s not uncommon regarding the foreign exchange market.

A good Fx agent is actually a friends one allows somebody trade money out of various countries. Very as opposed to Martingale or something like that comparable, my advice should be to learn rate step steps and methods. In addition to, if you are going to enhance the right position, only exercise when the marketplace is relocating your like.

Find the lowest measurements of your choice (based on the amount of the newest put). The fresh eligibility to own to be an excellent funded member is actually contingent up on fulfilling specific overall performance standards and you may compliance to your Company’s evaluation procedure. Never assume all profiles often be eligible for funded membership, and you can prior efficiency regarding the simulated environment is not indicative of upcoming victory. Four Percent On line Ltd. (“We”, “Our”, “Us”, or “Company”) works since the a proprietary trade firm. The firm is not a custodian, replace, financial institution, change system, fiduciary otherwise insurance rates team beyond your purview from financial regulatory government.

- The newest Anti-Martingale system has established-within the mechanisms for cutting exposure for every exchange which means ultimately cutting the possibility of destroying an investor’s account.

- It’s more vital than ever to know its positives and negatives to choose whether or not they’re also well worth with their.

- The fresh Martingale program mainly plans to increase the positioning in which an investor trades.

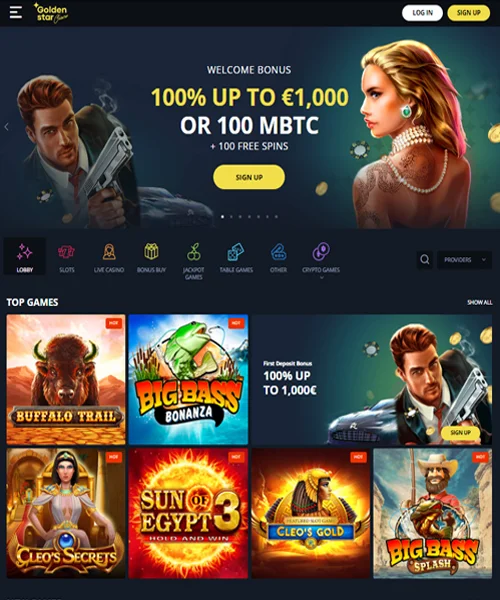

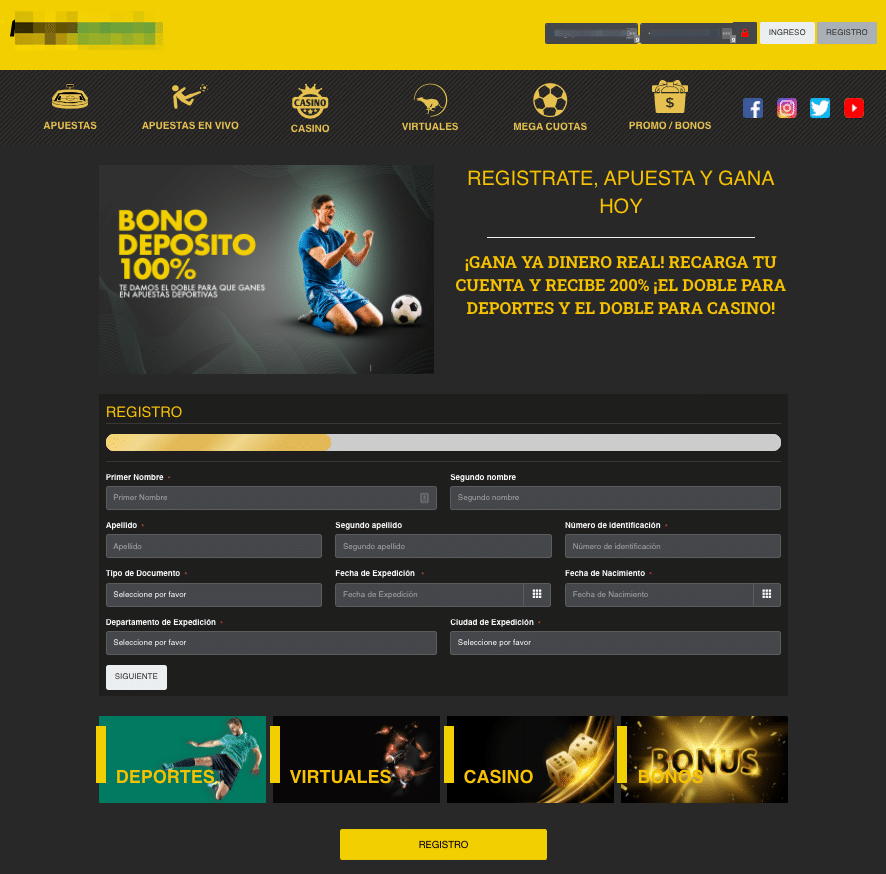

Improve money recuperation from the controlling chance government and you may using smartly. On the 18th century, the fresh Martingale strategy did actually provides came from easy coin toss video game inside France. It had been probably one of the most preferred playing tips inside the France, and it is considered that its identity originated in a French gambling establishment holder or at least a great French name for a kind of betting routine. Have you ever questioned should your Martingale strategy could help replace your trade efficiency for the Quotex? Just how legitimate is it with regards to managing investment inside binary options trading, particularly if trading to the Quotex program? Let’s examine these questions and see how to use this plan so you can Quotex trade.

At the same time, of a lot brokers features limitation exchange size limitations, which can avoid traders away from continuing the fresh Martingale strategy once an excellent specific area. The newest Martingale Method is made to help gamblers recover its losses from the doubling the bets after every losses. In that way, one win could easily eliminate previous loss as well as trigger a profit. This aspect of one’s method appeals to those people who are searching to have a fast and you can competitive treatment for get over a burning move.

Martingale method rate of success (victory speed)

Forex segments introduce book challenges for the Martingale method due to the brand new intrinsic influence plus the changeable effects of deals. The technique depends on the brand new trader’s power to sustain a series of losses and possess enough funding to keep increasing down up to a successful trade takes place. The main difference between this type of steps is their contrary solutions to exposure and money administration.

Whilst it seems like a scientific means on top, the strategy utilizes the belief you to a person features unlimited finance and this there are not any gambling limitations otherwise dining table limits positioned. In fact, extremely gambling enterprises enforce limitation betting restrictions, which can rapidly give the strategy useless. Do you feel just like there’s a guaranteed means to fix beat the chances and you can come out at the top when it comes to betting? Many gamblers and you will bettors the same provides wanted a strategy you to promises achievements inside their chosen online game. One such method that has gathered tremendous dominance is the Martingale Strategy. By the end, you’ll have an intensive understanding of that it confirmed gambling program.

This technique is within evaluate to the anti-Martingale program, that requires halving a gamble each time you will find a swap losings and you may doubling they when you will find a gain. Unlike the new anti-Martingale, which tries to attenuate exposure, the new Martingale technique is a risk-trying to form of paying one betrays a keen aversion so you can recognizing losings. There are a few cons when using the Martingale change means.

Because the risk of multiplying losses and you may fast reduced amount of winnings to investors try really serious. However, if you are calculated to make use of this process, at the very least be certain in the chance management. Margin is a hope you to definitely agents found from buyers depending on how big the new account. People have to have an enormous enough trade membership to withstand straight losings.

For example, you need to rally a couple loads of Euros (EUR)/You cash (USD) from one.181 to 1.182 to make sure you do not are unsuccessful of the first exchange. Even if MetaTrader and cTrader are not readily available, Plus500’s own platform is quite associate-friendly. It comes having a selection of easy to use risk management features and you may is available to your online and cellular.

You’ll need to deposit a minimum of $200 for Duplicate Trade, eToro’s talked about ability that allows one realize almost every other traders and you will backup its investments. Pepperstone now offers rigorous advances and reduced profits, which are very theraputic for carrying out a leading-volume change means such as Martingale. The value of your profile may go down as well as up-and you can get right back lower than your purchase. Committing to Brings, Products & Currencies may possibly not be right for people. It’s very important to run the screening which have a regulated and you can leading representative that provides aggressive advances.